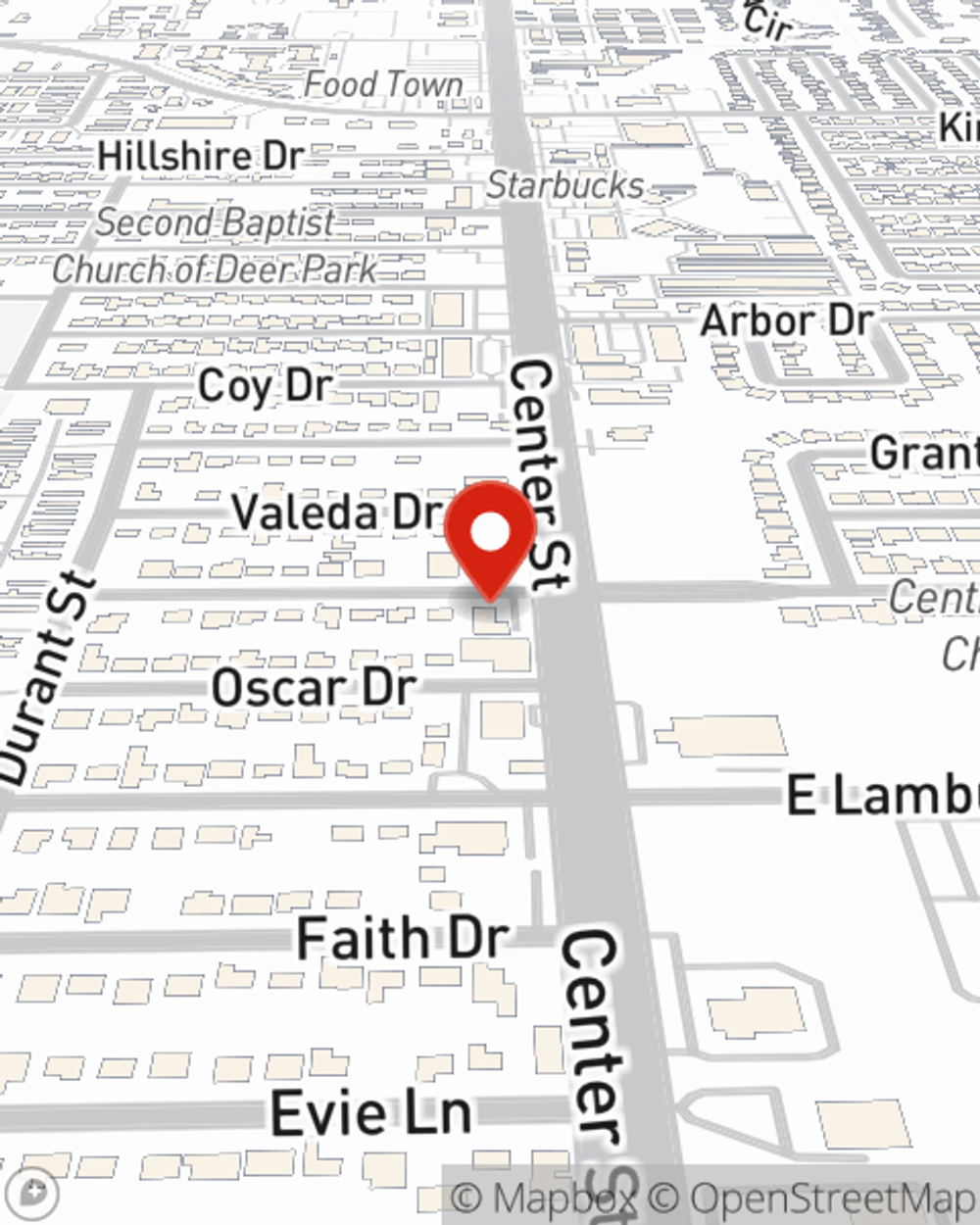

Condo Insurance in and around Deer Park

Here's why you need condo unitowners insurance

Insure your condo with State Farm today

- Seabrook

- Pasadena

- Houston

- League City

- Friendswood

- Clear Lake

- Pearland

- El Lago

- La Porte

- Baytown

- Dickinson

- Santa Fe

- River Oaks

- Galleria

- Bellaire

- Galveston

- Texas City

Your Belongings Need Coverage—and So Does Your Condominium.

There is much to consider, like deductibles coverage options, and more, when looking for the right condo insurance. With State Farm, this doesn't have to be a complicated decision. Not only is the coverage great, but it is also surprisingly well priced. And that's not all! The coverage can help provide protection for your condominium and also your personal property inside, including things like furnishings, books and pictures.

Here's why you need condo unitowners insurance

Insure your condo with State Farm today

Condo Unitowners Insurance You Can Count On

When a blizzard, a hailstorm or a tornado cause unexpected damage to your townhome or someone has an accident on your property, having the right coverage is vital. That's why State Farm offers such great condo unitowners insurance.

As a commited provider of condo unitowners insurance in Deer Park, TX, State Farm aims to keep your belongings protected. Call State Farm agent Will Norfolk today for help with all your condominium unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Will at (281) 479-3666 or visit our FAQ page.

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Will Norfolk

State Farm® Insurance AgentSimple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.